Why are rents moving upwards in Australia

Rental stock plunges to its lowest level since 2003

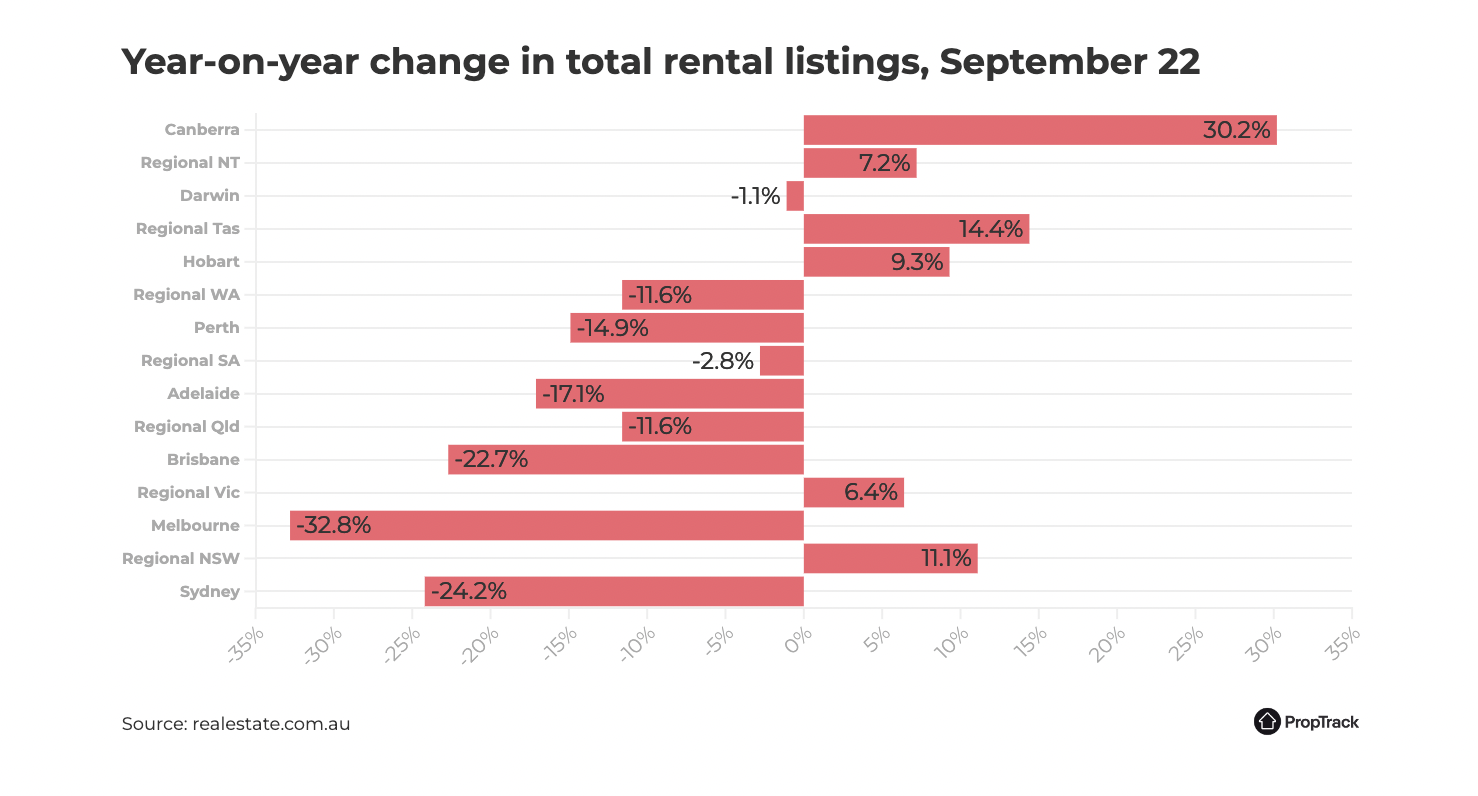

It seems scarcely believable, but many of Australia’s already tight rental markets are being squeezed further with the total number of rental listings on realestate.com.au plunging by 20.5% year-on-year over the September quarter, according to PropTrack.

That’s the lowest level of national stock in nearly two decades and means rental listing volumes are 32.5% below their decade average.

But here’s where it gets interesting.

Because while there’s been a decline in total rental stock over the year, not every capital city or rest-of-state area has seen an annual drop in supply.

In fact, as the chart below shows, some areas actually saw an increase.

Take Canberra, which recorded a staggering 30.2% increase in rental supply over the year to September. Regional Tasmania (+14.4%) and regional NSW (+11.1%) also saw double-digit increases.

By contrast, Melbourne (-32.8%) and Sydney (-24.2%) saw listing volumes plunge.

So what’s going on?

Well, to answer that question, consider what was happening in September 2021.

Back then, Australia’s international border was firmly shut and the pandemic was driving a population shift from the capital cities to the regions.

Sydney and Melbourne are the main destinations for many new migrants and overseas students. So the closed border reduced demand overnight. At the same time, Australia’s two largest cities were bearing the brunt of the population shift, comprising 99% of all net outflows over the 2021 calendar year, according to the Regional Movers Index.

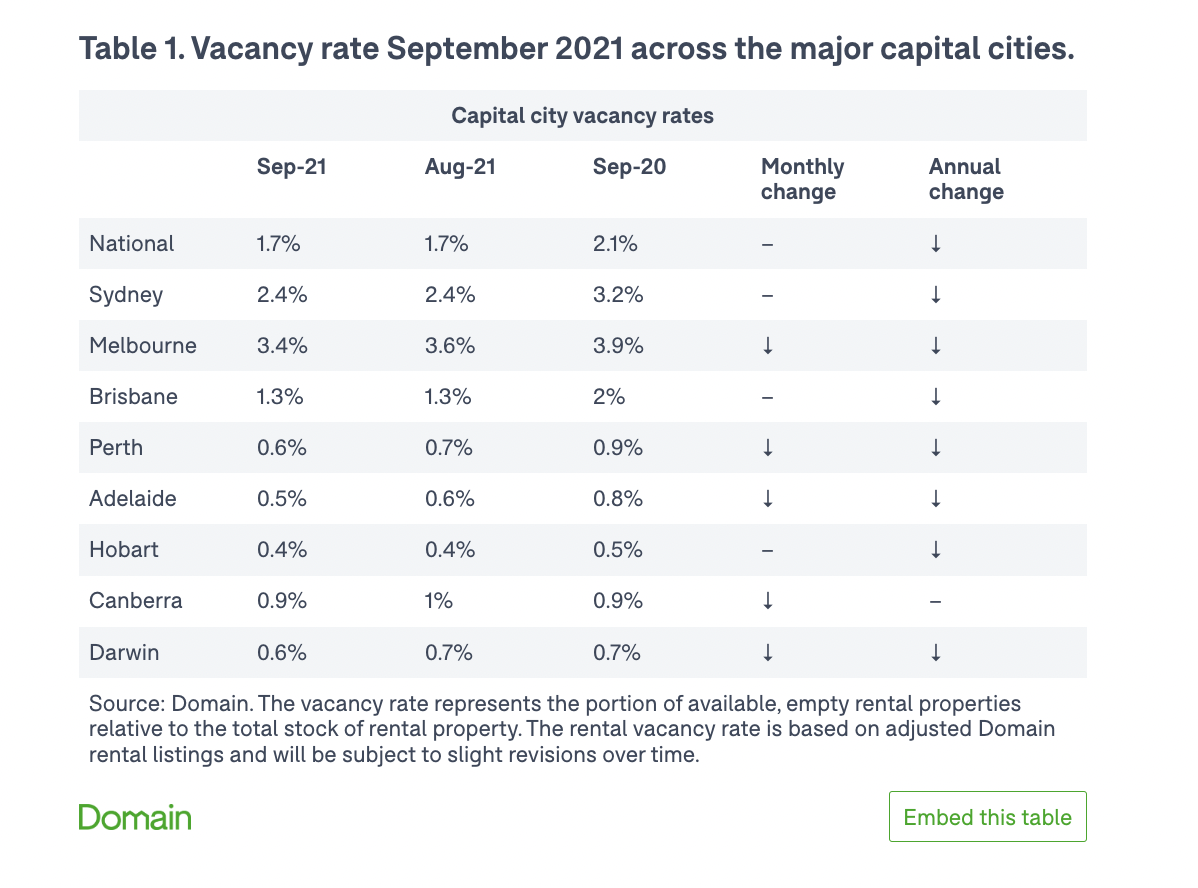

Those two factors had a direct impact on vacancy rates as the Domain table below shows.

Meanwhile, the property markets in both cities were still running red-hot so, unsurprisingly, many investors decided to sell up and cash in on the capital gain – reducing the supply of rental stock.

Demand returns with a bang

As restrictions eased and the international border reopened, Sydney and Melbourne rapidly regained their allure.

However, strong demand was met by low stock, driving up competition.

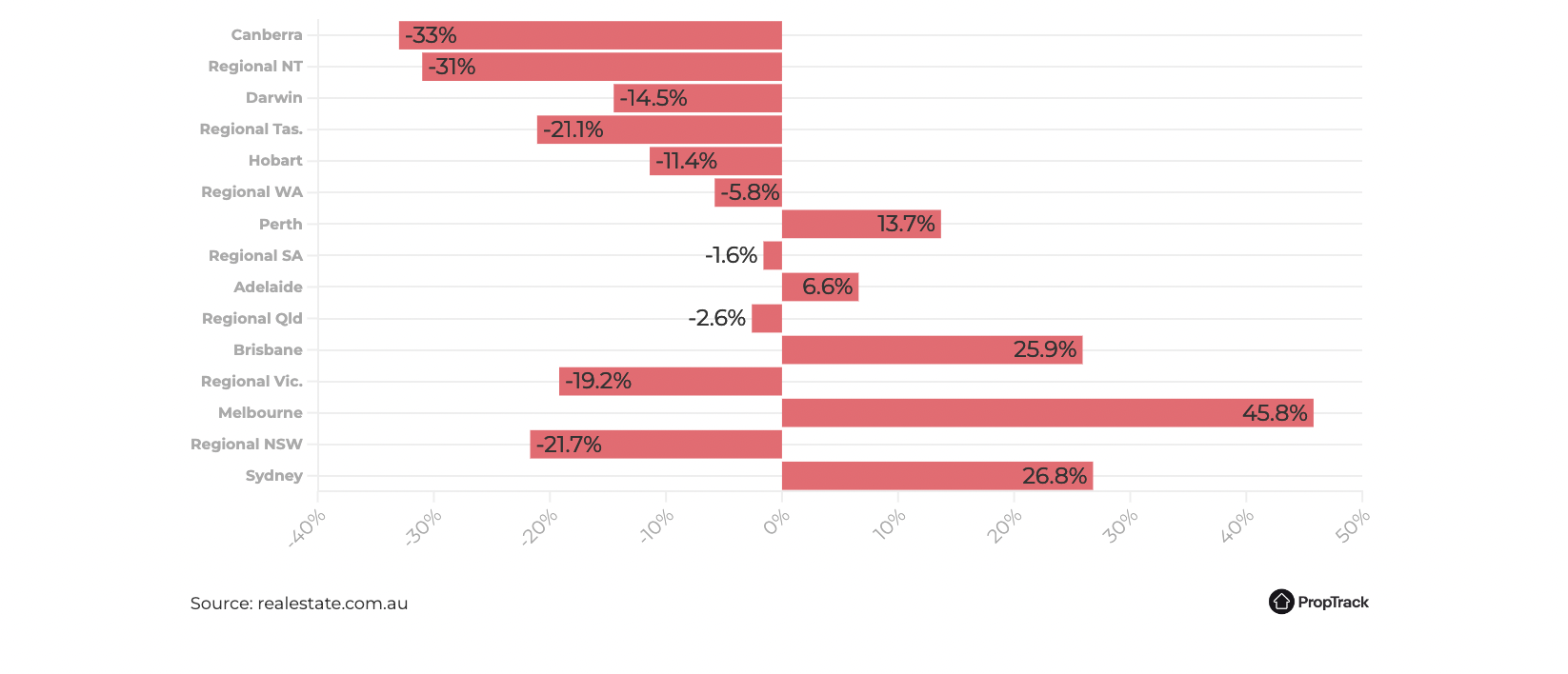

You can clearly see the impact this has had in the PropTrack graph below with Melbourne (45.8%) and Sydney (26.8%) seeing the largest year-on-year increase in potential renters per listing.

Fierce competition is sending rents skyward, with Melbourne and Sydney both seeing 10% annual growth in asking rents.

Things are going to get worse before they get better

To make matters worse, fewer investors are buying properties – with the value of investor lending falling 6.0% month-on-month in September, according to the most recent data from the Australian Bureau of Statistics.

That’s the fourth consecutive monthly drop and takes investor lending 25.1% below its recent peak.

PropTrack’s director of economic research, Cameron Kusher, said it was unlikely there would be an imminent easing of rental market pressures.

“With fewer investors purchasing homes to rent out, the limited supply of stock, coupled with strong demand, is leading to heightened increases in advertised rental prices,” Mr Kusher said.

“The solution to the current tight rental market is either more supply or less demand, or a combination of both. The share of lending to investors is trending lower and while there is some supply coming via build-to-rent, any additions are likely to be well and truly outweighed by the increase in demand from the re-opening of international borders and the ongoing decline in purchasing by first-home buyers.”

The moral of the story

The point is not to suggest that buying a Sydney or Melbourne investment property is a sure bet.

Rather, it’s to highlight how different Australian rental markets perform differently over any given timeframe.

So to be a successful investor and generate a long-term rental return, you always need to be selective about where and what you buy.

Looking to buy a high-quality investment property? Auswide Buyer’s Agency can help. To discuss your options, book a free consultation with Ashish Malhotra.