Land Tax Australia & QLD Land Tax Reforms

What is Land Tax

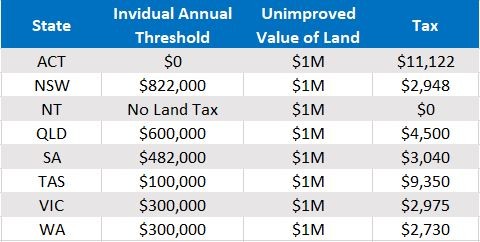

Land tax is an annual tax that landowners pay to state and territory governments on the combined unimproved value of your taxable property. It applies everywhere except for the Northern Territory. The laws between states are comparable, but they do vary.

Who pays Land Tax?

You don’t usually have to pay land tax on your main home (permanent residence). Any investor who owns a rented or vacant property is liable to pay land tax per the respective state thresholds.

Land Tax calculation

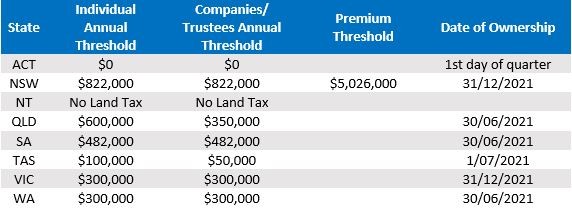

Land tax is calculated on the total value of all your taxable land above the land tax threshold in each state (except ACT and QLD), not on each individual property. If the combined value of your land does not exceed the threshold, no land tax is payable. Your liability for each year is based on the value of all land you owned on the date of ownership for previous year. Any changes to the land you own this year will only affect how much you pay next year.

Land Tax thresholds for each state

How much Tax would you pay 1M land value in each state

Links for revenue office of each state

ACT – https://www.revenue.act.gov.au/land-tax

NSW – https://www.revenue.nsw.gov.au/taxes-duties-levies-royalties/land-tax

NT – No Land Tax

QLD – https://www.qld.gov.au/environment/land/tax/calculation/value

SA – https://www.revenuesa.sa.gov.au/landtax

TAS – https://www.sro.tas.gov.au/land-tax

VIC – https://www.sro.vic.gov.au/land-tax-current-rates

WA – https://www.wa.gov.au/organisation/department-of-finance/land-tax#calculation-of-land-tax

Land Tax valuation

Every year, the revenue office or Valuer General (as applicable) determines the value of all land at 1st July each year. Land value is the unimproved value of the land.

Fun Facts about Land Tax

- There is no land tax on commercial property in ACT

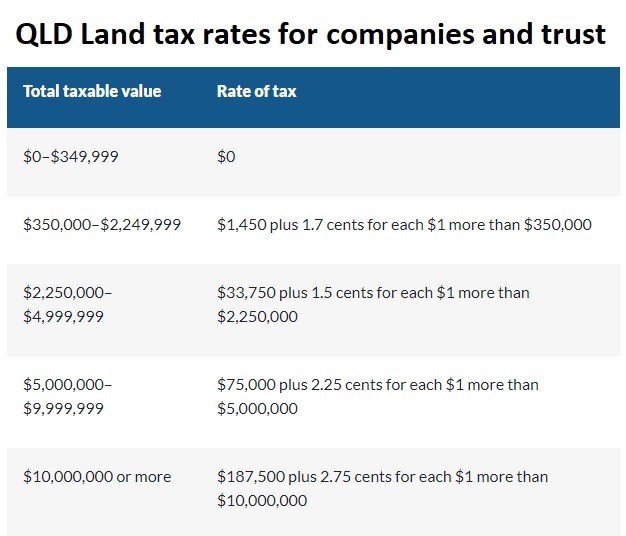

- QLD is the only state where threshold is less for companies and trustee ownership

- There is no land tax in NT

- There is no minimum land tax threshold in ACT

- Starting 2023, Your land in QLD will be taxed even if the value of land owned in any other state than QLD exceeds QLD land tax threshold.

- All states in Australia (except QLD from 2023) have their own thresholds and land owned in one state is independent of the other (except QLD from 2023).

- Two partners can have properties on different names and still be assessed with separate threshold values.

QLD 2023 Land Tax reforms: What is changing?

From 30 June 2023, use the total value of your Australian land will be used to calculate the land tax. This includes your taxable land in Queensland and your relevant interstate land. ‘Relevant interstate land’ includes land located in another state or territory that is valued under interstate valuation legislation and is not excluded interstate land.

The total value of your Australian land will be used to determine:

- whether the tax-free threshold has been exceeded

- the rate of land tax that will be applied to the Queensland proportion of the value of your landholdings.

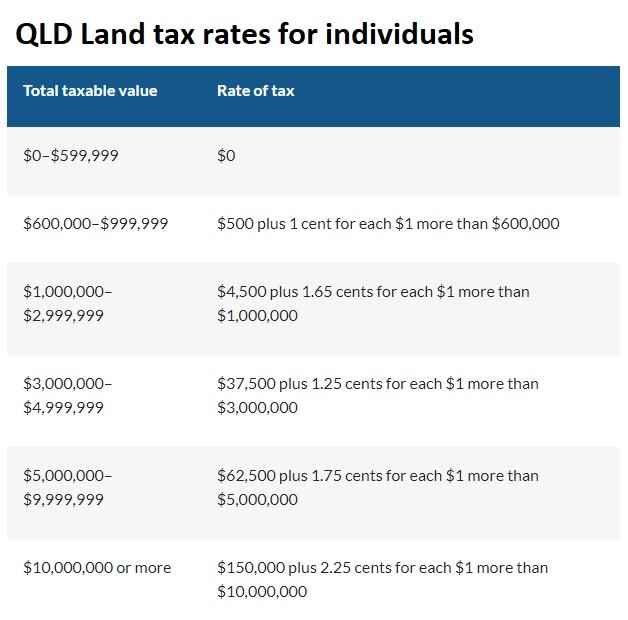

The current tax-free thresholds are $600,000 for individuals (other than absentees) and $350,000 for companies, trustees and absentees.

You’ll only pay tax on the land you own in Queensland (i.e. we are not taxing your land outside Queensland).

Example

On 30 June 2022, Lena owns land in Queensland with a taxable value of $745,000. Her land tax is calculated using the rates for individuals.

Taxable value of land: $745,000

Calculation

= $500 + (1 cent × $145,000)

= $500 + $1,450

= $1,950

QRO will issue an assessment notice for $1,950 for the 2022–23 financial year.

On 30 June 2023, the value of Lena’s land in Queensland has not changed. But Lena now also owns land in Victoria valued at $1,565,000. The total value of Australian land owned by Lena is $2,310,000, which means the land tax is calculated using a higher rate for individuals.

This is how Lena’s land tax will be calculated:

Taxable value of Australian land: $2,310,000

Calculation

= $4,500 + (1.65 cents × $1,310,000)

= $4,500 + $21,615

= $26,115

This amount is applied to the Queensland portion of Lena’s land (i.e. ($745,000 ÷ $2,310,000) × $26,115)).

QRO will issue an assessment notice for $8,422.37.

QLD Land Tax rates